8 Critical Skills To (Do) Gold Vs Stocks Loss Remarkably Effectively

페이지 정보

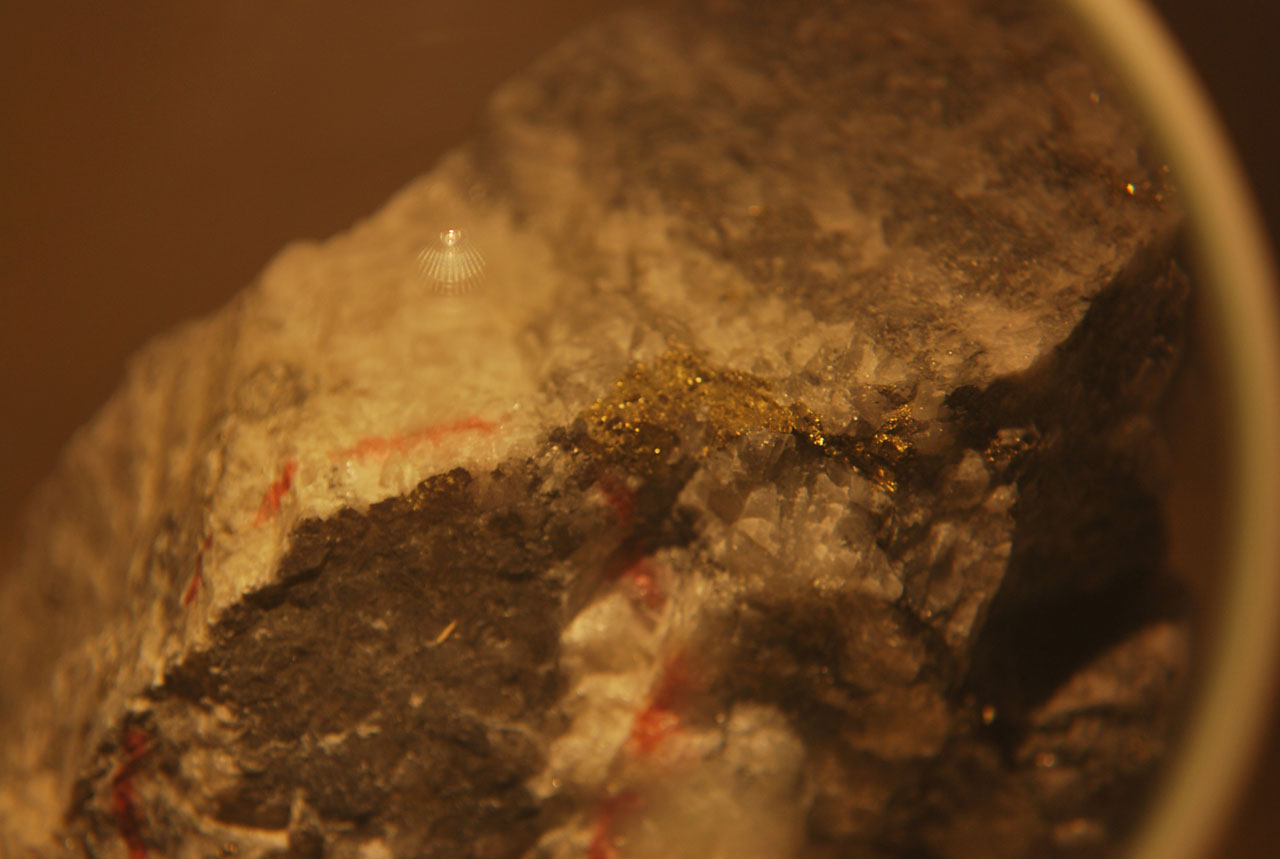

Please be aware that again in 2016, there was an extra quick upswing earlier than the slide and this additional upswing has brought on the Gold Miners Bullish Percent Index to move up once again for a couple of days. Back in 2016, designon2014.co.kr after we noticed this phenomenon, it was already after the highest, and proper earlier than the big decline. Starting from low valuations, we imagine the higher volatility of exploration mining stocks, as indicated in the 2 charts above, compared to different financial devices can doubtlessly work in one’s favor, like we noticed in 2001 to 2007, in 2008 to 2011, and in our own precious metals fund from its inception on 8/1/2020 through May 31, 2021 when it climbed 251% net of fees in simply eight months while it was substantially allotted to exploration mining stocks. 1 - Net returns mirror the performance of an investor who invested from inception and is eligible to participate in new points and aspect pocket investments.

Please be aware that again in 2016, there was an extra quick upswing earlier than the slide and this additional upswing has brought on the Gold Miners Bullish Percent Index to move up once again for a couple of days. Back in 2016, designon2014.co.kr after we noticed this phenomenon, it was already after the highest, and proper earlier than the big decline. Starting from low valuations, we imagine the higher volatility of exploration mining stocks, as indicated in the 2 charts above, compared to different financial devices can doubtlessly work in one’s favor, like we noticed in 2001 to 2007, in 2008 to 2011, and in our own precious metals fund from its inception on 8/1/2020 through May 31, 2021 when it climbed 251% net of fees in simply eight months while it was substantially allotted to exploration mining stocks. 1 - Net returns mirror the performance of an investor who invested from inception and is eligible to participate in new points and aspect pocket investments.

As a commodity-based funding, the performance of stocks and shares throughout the gold trade may be risky, particularly over shorter periods. Also, the share worth performance could not simply be all the way down to the price of gold. So, if a company deviates from these requirements it could also be an indication that they don't seem to be reputable. But simply because there are fewer transferring elements doesn’t inherently make it much less dangerous. None of this is based on delight of opinion, I simply wish to reveal the markets indicators in an try to protect oneself and in the end make cash. And in the event that they move within the path you predicted, you may make substantial sums. Which means it’s likely that it is a counter-trend bounce, and never the bigger move increased. Given the overbought status of the RSI (given today’s upswing, it's almost sure to maneuver above 70 once once more) as well as miners current unwillingness to trace gold during its steady rally, it’s highly doubtless in my view that this will likely be a high. Please notice that it’s just a small fraction of today’s full Gold & Silver Trading Alert. Thank you for reading today’s free analysis.

As a commodity-based funding, the performance of stocks and shares throughout the gold trade may be risky, particularly over shorter periods. Also, the share worth performance could not simply be all the way down to the price of gold. So, if a company deviates from these requirements it could also be an indication that they don't seem to be reputable. But simply because there are fewer transferring elements doesn’t inherently make it much less dangerous. None of this is based on delight of opinion, I simply wish to reveal the markets indicators in an try to protect oneself and in the end make cash. And in the event that they move within the path you predicted, you may make substantial sums. Which means it’s likely that it is a counter-trend bounce, and never the bigger move increased. Given the overbought status of the RSI (given today’s upswing, it's almost sure to maneuver above 70 once once more) as well as miners current unwillingness to trace gold during its steady rally, it’s highly doubtless in my view that this will likely be a high. Please notice that it’s just a small fraction of today’s full Gold & Silver Trading Alert. Thank you for reading today’s free analysis.

Especially, when we consider the fact that Gold Miners Bullish Percent Index showed the best potential overbought reading just lately. This is seriously disrespectful to their shareholders, who deserve timely quarterly results released as early as attainable. That would very nicely apply to the current situation around PMs. You possibly can keep monitor of the worth of your investment by monitoring the current value of gold. It supplies free trial entry to its finest funding instruments (including lists of finest gold stocks and greatest silver stocks), proprietary gold & silver indicators, buy & promote signals, weekly newsletter, and extra. In different phrases, traders would have about 119 occasions more money by investing in a diversified portfolio of large stocks than by investing in gold. At the end of Q1 2021, 17 hedge funds tracked by Insider Monkey have positions in Royal Gold, Inc. (NASDAQ: RGLD), price $237 million. Check more of our free articles on our webpage, together with this one - ju7st drop by and take a look. For some extra steering, you may learn our in-depth guide on how to purchase stocks and shares. "For investment, silver attracts primarily smaller and retail investors, as it's more accessible and perceived to offer higher worth given its decrease worth relative to gold," says Agrawal.

Combine the USDX situation with Gold Miners' Bullish Percent and vertex-based mostly reversal, and also you get a excessive chance of decrease costs in miners next. Speaking of indications pointing to the scenario being extreme, let’s have a look at the USD Index. People had been very sad with us writing that day after day, although the USD Index refused to soar, and gold was not declining. And while gold would possibly play an necessary half in your diversified portfolio, placing your entire eggs in a single basket (even when that basket is 14-karat gold) isn't a good idea. They didn’t handle to even erase their Thursday’s decline. The excessive bullishness was present at the 2016 top as properly and it didn’t trigger the situation to be any much less bearish in actuality. Given the scenario within the USD Index, it seems that we’re seeing the identical thing also this time. A enterprise is an financial entity creating worth and in doing so, grows in worth over time. Over long time-horizons, they deviate wildly from their stated goals." In other words, if you want all the pieces about gold except that pesky stability and the way gold maintains its worth over the long haul, this is the funding for you!

- 이전글5 Small Wood Burner Lessons From The Professionals 24.12.05

- 다음글You'll Never Guess This Truck Lawyers Near Me's Secrets 24.12.05

댓글목록

등록된 댓글이 없습니다.